Every year we like to help our clients gain benefits in all areas to maximize their rental returns. In saying that we have sought out some of the states most well renowned professionals to help you keep your hard earned money in your back pocket.

We have worked hard to get the best deal possible for our owners and investors that are yet to take advantage of tax offsets. This comes in the form a Depreciation Schedule. As always, we live and strive to connect the dots for our clients and local investors so have been able to get one of Brisbane’s leading Quantity Surveying firms to give our clients a discount. Usually $850.00 per report we have been able to get them down to $650.00 inc GST as we near the end of financial year.

Property businesses are not just property businesses, and the same is true for Quantity Surveying when it comes to ensuring you have claimed every last cent possible relating to your investment property. For this reason we have chosen a firm that is on the panel for one of the major banks to make sure we guarantee our value to you in our motto of connecting the dots.

Remember at The Property Management Collective, we are all about understanding how and where, you can spend money in the right areas to squeeze every last cent out of your investments. So reach out to us today to find out more about other items you can talk with your accountant about as we near end of financial year. This way you can set yourself up for success with your next tax return.

Rental Deductions to Think About if you have’t already, can be seen below as an example of key areas where can claim immediate tax deductions relating to your investment/rental property:

- Accounting Fees

- Advertising for Tenants

- Agency Fees & Commission

- Body Corporate Fees

- Depreciation on Furniture, Fittings & Building Improvements

- Insurance (building, contents & rental protection)

- Interest on Loans

- Land Tax

- Lease Document Expenses

- Pest Control

- Repairs & Maintenance

- Stationary, Postage & Telephone Calls

- Travel Expenses (for rent collection, inspections & maintenance of the property)

- Water Charges & Council Service Fees such as QUU

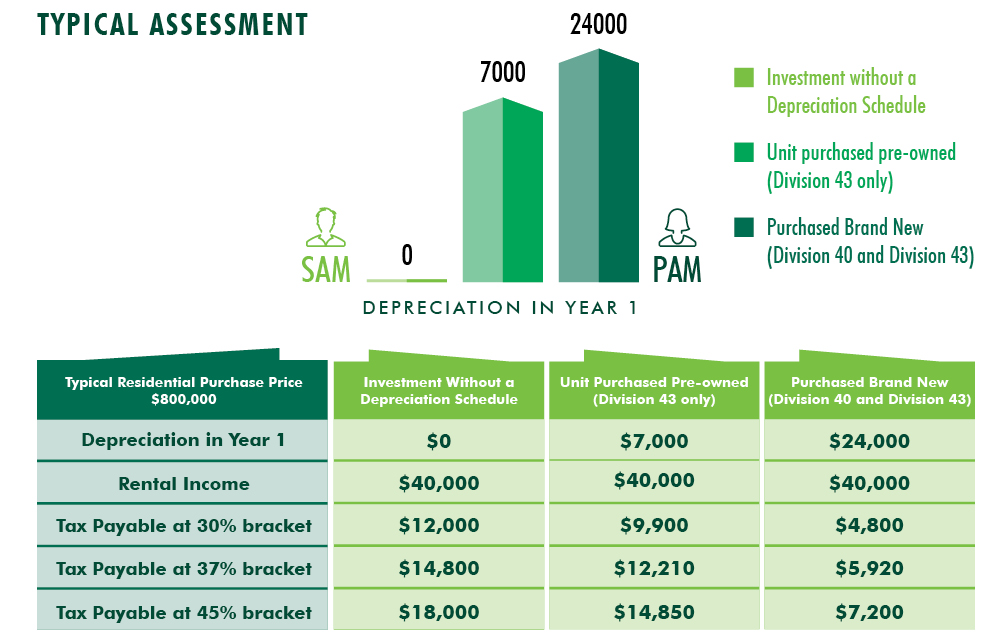

Example below:

Look forward to chatting with you more to talk through other examples of how we protect your income and focus on growth of your portfolio.